IRS Requirements to Deduct Alimony on Your Tax Return

- At April 27, 2020

- By Miles Mason

- In After Divorce, Alimony, Divorce Tips

0

0

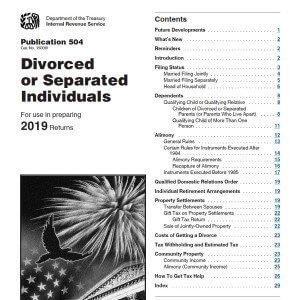

IRS Requirements to Deduct Alimony on Your Tax Return: IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

In order to be allowed to deduct your alimony payments, what is required? The IRS takes a dim view of former spouses to game the tax system by disguising property transfer in the form of alimony. Here, we discuss more details on cash payments, not designated as alimony, can’t be members of the same household, not child support, no contingency based on child, substitute payments, and alimony owed past death.

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: With alimony, there are technical answers and there are practical answers. The practical answers come with many years of experience. (My dad was a tax CPA for over 35 years in Memphis.) So what? My strong recommendation is not to play around by guessing. Engage an experienced CPA you trust to help you make close calls. Plus, what makes alimony a mess to figure out is that the terms used by the IRS don’t easily translate into corresponding terms in Tennessee family law.

Mason Comment 3: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Alimony. Amounts paid as alimony or separate maintenance payments under a divorce or separation instrument executed after 2018 won’t be deductible by the payer. Such amounts also won’t be includible in the income of the recipient. The same is true of alimony paid under a divorce or separation instrument executed before 2019 and modified after 2018, if the modification expressly states that the alimony isn’t deductible to the payer or includible in the income of the recipient.

Alimony Requirements

A payment to or for a spouse under a divorce or separation instrument is alimony if the spouses don’t file a joint return with each other and all the following requirements are met.

- The payment is in cash.

- The instrument doesn’t designate the payment as not alimony.

- The spouses aren’t members of the same household at the time the payments are made. This requirement applies only if the spouses are legally separated under a decree of divorce or separate maintenance.

- There is no liability to make any payment (in cash or property) after the death of the recipient spouse.

- The payment isn’t treated as child support. Each of these requirements is discussed next.

Cash payment requirement. Only cash payments, including checks and money orders, qualify as alimony. The following don’t qualify as alimony.

- Transfers of services or property (including a debt instrument of a third party or an annuity contract).

- Execution of a debt instrument by the payer.

- The use of the payer’s property.

Payments to a third party. Cash payments to a third party under the terms of your divorce or separation instrument can qualify as cash payments to your spouse. See Payments to a third party under General Rules, earlier.

- The payments are in lieu of payments of alimony directly to your spouse.

- The written request states that both spouses intend the payments to be treated as alimony.

- You receive the written request from your spouse be- fore you file your return for the year you made the payments.

Payments designated as not alimony. You and your spouse can designate that otherwise qualifying payments aren’t alimony. You do this by including a provision in your divorce or separation instrument that states the payments aren’t deductible as alimony by you and are excludable from your spouse’s income. For this purpose, any instrument (written statement) signed by both of you that makes this designation and that refers to a previous written separation agreement is treated as a written separation agreement (and therefore a divorce or separation instrument). If you are subject to temporary support orders, the designation must be made in the original or a later temporary support order.

Your spouse can exclude the payments from income only if he or she attaches a copy of the instrument designating them as not alimony to his or her return. The copy must be attached each year the designation applies.

Spouses can’t be members of the same household. Payments to your spouse while you are members of the same household aren’t alimony if you are legally separated under a decree of divorce or separate maintenance. A home you formerly shared is considered one household, even if you physically separate yourselves in the home.

You aren’t treated as members of the same household if one of you is preparing to leave the household and does leave no later than 1 month after the date of the payment.

Exception. If you aren’t legally separated under a decree of divorce or separate maintenance, a payment under a written separation agreement, support decree, or other court order may qualify as alimony even if you are members of the same household when the payment is made.

Liability for payments after death of recipient spouse. If any part of payments you make must continue to be made for any period after your spouse’s death, that part of your payments isn’t alimony whether made before or after the death. If all of the payments would continue, then none of the payments made before or after the death are alimony.

The divorce or separation instrument doesn’t have to expressly state that the payments cease upon the death of your spouse if, for example, the liability for continued payments would end under state law.

Mason Comment: If you owe alimony in solido as described and defined in Tennessee law, definitely address this requirement with your CPA or tax attorney!

Example. You must pay your former spouse $10,000 in cash each year for 10 years. Your divorce decree states that the payments will end upon your former spouse’s death. You also must pay your former spouse or your former spouse’s estate $20,000 in cash each year for 10 years. The death of your spouse wouldn’t end these payments under state law.

The $10,000 annual payments may qualify as alimony. The $20,000 annual payments that don’t end upon your former spouse’s death aren’t alimony.

Substitute payments. If you must make any payments in cash or property after your spouse’s death as a substitute for continuing otherwise qualifying payments before the death, the otherwise qualifying payments aren’t alimony. To the extent that your payments begin, accelerate, or increase because of the death of your spouse, otherwise qualifying payments you made may be treated as payments that weren’t alimony. Whether or not such payments will be treated as not alimony depends on all the facts and circumstances.

Example 1. Under your divorce decree, you must pay your former spouse $30,000 annually. The payments will stop at the end of 6 years or upon your former spouse’s death, if earlier.

Your former spouse has custody of your minor children. The decree provides that if any child is still a minor at your spouse’s death, you must pay $10,000 annually to a trust until the youngest child reaches the age of majority. The trust income and corpus (principal) are to be used for your children’s benefit.

These facts indicate that the payments to be made after your former spouse’s death are a substitute for $10,000 of the $30,000 annual payments. Of each of the $30,000 annual payments, $10,000 isn’t alimony.

Example 2. Under your divorce decree, you must pay your former spouse $30,000 annually. The payments will stop at the end of 15 years or upon your former spouse’s death, if earlier. The decree provides that if your former spouse dies before the end of the 15-year period, you must pay the estate the difference between $450,000 ($30,000 × 15) and the total amount paid up to that time. For example, if your spouse dies at the end of the 10th year, you must pay the estate $150,000 ($450,000 − $300,000).

These facts indicate that the lump-sum payment to be made after your former spouse’s death is a substitute for the full amount of the $30,000 annual payments. None of the annual payments are alimony. The result would be the same if the payment required at death were to be discounted by an appropriate interest factor to account for the pre-payment.

Child support. A payment that is specifically designated as child support or treated as specifically designated as child support under your divorce or separation instrument isn’t alimony. The amount of child support may vary over time. Child support payments aren’t deductible by the payer and aren’t taxable to the payee.

Specifically designated as child support. A payment will be treated as specifically designated as child support to the extent that the payment is reduced either:

- On the happening of a contingency relating to your child, or

- At a time that can be clearly associated with the contingency.

A payment may be treated as specifically designated as child support even if other separate payments are specifically designated as child support.

Contingency relating to your child. A contingency relates to your child if it depends on any event relating to that child. It doesn’t matter whether the event is certain or likely to occur. Events relating to your child include the child’s:

- Becoming employed,

• Dying,

• Leaving the household,

• Leaving school,

• Marrying, or

• Reaching a specified age or income level.

Clearly associated with a contingency. Payments that would otherwise qualify as alimony are presumed to be reduced at a time clearly associated with the happening of a contingency relating to your child only in the following situations.

- The payments are to be reduced not more than 6 months before or after the date the child will reach 18, 21, or local age of majority.

- The payments are to be reduced on two or more occasions that occur not more than 1 year before or after a different one of your children reaches a certain age from 18 to 24. This certain age must be the same for each child, but need not be a whole number of years.

In all other situations, reductions in payments aren’t treated as clearly associated with the happening of a contingency relating to your child.

Either you or the IRS can overcome the presumption in the two situations above. This is done by showing that the time at which the payments are to be reduced was deter- mined independently of any contingencies relating to your children. For example, if you can show that the period of alimony payments is customary in the local jurisdiction, such as a period equal to one-half of the duration of the marriage, you can overcome the presumption and may be able to treat the amount as alimony.

Divorce & Taxes: Your 2019 Update

See Miles Mason, Sr.’s article which was the cover story for the Tennessee Bar Journal: Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan.

See our Tennessee Family Law Blog post series on Divorce & Taxes 2019:

- IRS “Reminders” for Divorced or Separated Individuals

- IRS Requirements to Deduct Alimony on Your Tax Return

- General Tax Rules for Alimony After Divorce

- If You Qualify, You Want to File as Head of Household After Divorce

- 2019 Tax Law: Transfer of Property in a Divorce Settlement

- Are legal fees for divorce tax deductible in 2019?

- Dividing an IRA: 2019 Tax & Divorce Law

- Who Pays the Taxes on a QDRO Distribution after Divorce?

- Sale of Principal Residence after Divorce: 2019 Tax Law

- Assignment of Estimated Tax Payments in a Divorce