Who Gets the Credit? Child Tax Credit, Dependent Care Credit

Who Gets the Credit?

Calculating the New Child Tax Credits in Your Parenting Plan

Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan | March 2019 cover story for Tennessee Bar Journal

Cover story for the March 2019 Tennessee Bar Journal. Citation: 55 Tennessee Bar Journal, 3 (Mar. 2019). Copyright 2019 Tennessee Bar Journal and Miles Mason Family Law Group, PLC. Reprinted with permission.

New tax law? Really? Really. The children’s dependency deductions are gone. What’s next? The Child Tax Credit (CTC) helps fill that gap. The cool thing about credits is that they are dollar for dollar reductions of tax, not a reduction of taxable income. This means that the parents’ marginal federal income tax rate does not impact the value associated with the reduction.

Accordingly, Tennessee’s permanent parenting plan form is likely to be amended. While parents cannot share the CTC, the associated tax benefits can be transferred to the alternate residential parent under certain circumstances, including by use of IRS Form 8332. We are talking about real money here, up to $2,000 per year per child. This article is written with the perspective that parents will want to collectively take advantage of the biggest financial benefit available from the new laws. For more details on the new tax law, see “Elimination of the Alimony Deduction: A Tax Break for Some, a Hike for Others”, by Marlene Moses and Manuel Russ, Tennessee Bar Journal, January 2018, Vol. 54, No. 1.

Attorneys are advised to read instructions for IRS Form 8332 and related pages, including Publication 501, Dependents, Standard Deduction and Filing Information, as well as Publication 504, Divorced or Separated Individuals. All IRS publications are available as PDFs online. IRS publications offer easy explanations. Remember that it is important to always consult with your client’s CPA or tax professional. The details matter!

TCJA Suspended Personal Exemptions

There have been many changes to child-related tax benefits. One of the biggest being recent suspension of all personal exemptions under the Tax Cuts and Jobs Act (TCJA). Not some, all. The TCJA is effective for tax years beginning Jan. 1, 2018, through Dec. 31, 2025, when the law sunsets. Elimination of personal exemption deductions began with tax year 2018.

Prior law entitled a parent to an exemption deduction for himself or herself and for each child. The exemption amount was $4,050 per person. In claiming two children, for example, the parent’s exempt amount from income was $4,050 for each person or $12,150 (3 x $4,050). The parent’s income was lowered by the exempt amount, resulting in reduced tax liability. That’s gone now. No personal exemptions remain. The gap left by eliminating the children’s dependency deductions, however, has been filled by the CTC. In some cases the increase in standard deduction can help fill the gap as well.

Still Determine Personal Exemption for Other Tax Benefits

Although the personal exemption deduction is no longer available, the analysis remains important. It is still necessary to determine which parent is eligible to claim the children. Why? Because the result translates into eligibility for other tax benefits — namely, Head of Household filing status and the Child Tax Credit.

The TCJA increased the standard deduction for Head of Household, increased the CTC amount, and increased the income limitations. With a little guidance during settlement proceedings, parties can use their parenting plan to reap the greatest tax benefits.

Settling Tax Issues in the Parenting Plan

When settling and mediating a parenting plan, attorneys should include scenarios explaining how the TCJA will impact respective parental income tax liabilities. The goal? Keeping financial resources in the family by taking full advantage of the new IRS tax rules. With that objective in mind, in every divorce and child support mediation assessment include how both parents might extract the greatest benefit from the new child-related tax regime. The only way to do this accurately is to compare options using the parents’ actual income information and contrast results.

Changed Landscape for Child-Related Tax Benefits

- Where to start? Begin when negotiating a parenting plan agreement, by assisting parents with addressing three key tax questions:

- Which parent files as Head of Household?

- Which parent claims the Child Tax Credit?

- Which parent claims the Dependent Care Credit?

A case example at the end of this article applies each step to a parenting plan settlement.

Let’s begin with the standard deduction.

1.Which Parent Files as Head of Household?

What benefit does filing for Head of Household status bestow? The standard deduction for Head of Household in 2018 is $18,000 — that’s a meaningful subtraction from income (up from $9,350 in 2017). It is also substantial compared to the standard deduction for filing Single, which in 2018 is $12,000. The news gets even brighter. Higher earners can also claim the deduction now. The TCJA increased income limitations to $200,000 AGI for Single Head of Household filers and $400,000 for Married Filing Jointly. (Compare that to the $75,000 AGI income limitation for 2017.)

Requirements for Head of Household

To file as Head of Household, the parent must be “considered unmarried” (or is separated, as noted below). Additionally, the parent must have paid more than half the household expenses in 2018 with a “qualifying person” (the child) living with him or her in that home for more than half the year. That’s all well and good. But what if the divorce is still pending after Dec. 31, 2018?

If the spouses lived separately in 2018, then a parent may still be “considered unmarried” for purposes of the Head of Household standard deduction. The general requirements for filing while still legally married are:

- The parties do not file a joint return;

- The parent paid at least half what the residence cost for that tax year;

- The spouses did not live together at all during the second half of the year (separated all six months);

- The child, step-child or foster child lived mainly in that home with the filer for at least half the year; and

- The child can be claimed as the filer’s dependent.

Exceptions may apply to the parents’ circumstances.

Under IRS rules, the “custodial parent” is the one with whom the child lived for the greater number of nights during the year. This parallels the primary residential parent (PRP) designation in Tennessee family law. Therefore, the custodial parent, or PRP, may claim the children for Head of Household filing status to obtain the $18,000 standard deduction if that amount exceeds the PRP’s itemized deductions.

What if parents shared equal overnights with their child? As a general rule, the custodial parent in that instance would be the one with the higher AGI. (There are exceptions, such as parents who work nights.)

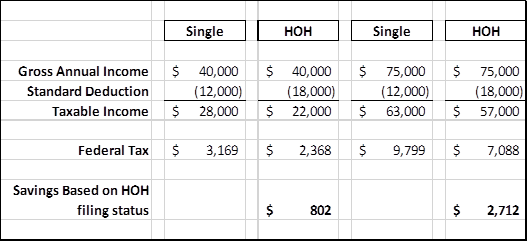

Family lawyers should know that the financial difference between filing Head of Household and filing Single depends on the parent’s income and marginal tax rate. As the chart above describes, for a parent earning $40,000 per year, the difference in filing status results in a tax savings of $802 per year. For the parent earning $75,000 per year, being able to file as Head of Household can save $2,712 per year.

2. Which Parent Claims the Child Tax Credit?

Here’s where the Child Tax Credit comes in. The CTC for 2017 was $1,000 per child. That doubled for 2018 and later years — the credit is now $2,000 per child. Although this is a dollar-for-dollar credit against the filer’s tax liability, be mindful the CTC begins to phase-out for unmarried taxpayers with an AGI of $200,000. When the parent’s AGI reaches the $200,000 income threshold, the credit is reduced by $50 for each $1,000, or fraction thereof, exceeding the threshold amount. For example, a PRP of one child with an AGI of $206,000 would see the $2,000 maximum credit reduced by $300 for a CTC total of $1,700.

Transfer of Child Tax Credit to Non-Custodial Parent

The Child Tax Credit could be transferred to the non-custodial parent as the alternate residential parent (ARP) using IRS Form 8332 — “Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.” The PRP completes Form 8332, not the ARP. For settlement purposes, Form 8332 could be used to release the entitled parent’s claim to the CTC for one or more of the children, allowing the ARP to claim the CTC for that child. This transfer does not entitle the ARP to file as Head of Household or to claim the Dependent Care Credit.

Tread lightly. As the example below illustrates, transferring the CTC might not be beneficial to the recipient parent. Crunch the numbers.

3. Which Parent Claims the Dependent Care Credit?

Lastly, there is the Dependent Care credit to consider. The DCC is also a dollar-for-dollar credit against the claiming parent’s tax liability. However, this credit is only available for work-related child-care actually paid (emphasis on “work-related”). In the case of divorced or separated parents, only the custodial parent (the PRP) is eligible to claim this child care credit.

The maximum child care credit for 2018 is $3,000 per child multiplied by 20 percent based upon the custodial parent’s income. Remember: the DCC is not available to the ARP. This is true even when the CTC is transferred to the ARP with Form 8332.

One option? Given only the custodial parent can claim the Dependent Care Credit, the parties may agree to the PRP paying for child care, claiming the credit, and including the care cost in their child support calculations. In other words, the PRP could pay for child care directly while the ARP’s payments are calculated to include an amount sufficient for the PRP to recover funds spent directly on work-related child care.

Parenting Plan Example Under New Tax Law

The Facts: Mary Smith (Mother) is an attorney with Smith & Associates earning a $200,000 annual salary. Joseph Smith (Father) works for Memphis Bank at a salary of $75,000 per year. Both are 42 years old with many working years ahead. They have three children: Sarah (age 12), Ben (age 10) and Taylor (age 2).

Mother pays $300 per month for the children’s health insurance. She also pays work-related child care for their two-year-old, Taylor, at $1,200 per month. Father works a reduced schedule so he can be home with all of the children after school. Therefore, there is no work-related child care for the two older children.

As PRP, Father has primary custody of the three children. Based upon their current parenting plan, Father has 225 overnights per year and Mother has 140 overnights per year.

Tax Options: In the 2017 tax year, Father would have been entitled to personal exemptions for himself and all three children at $4,050 each or $16,200 (4 x $4,050). With personal exemptions eliminated in 2018, the analysis is as follows:

Who Files as Head of Household?

As the primary residential parent for all three children, Father is entitled to claim the children for Head of Household filing status. This gives him the $18,000 standard deduction.

Who Claims the Child Tax Credit?

With an income of $75,000 per year, Father is eligible to receive the credit in the amount of $2,000 per child. His total CTC is $6,000 for the three children, per year.

Option: Under these facts, Form 8332 could be used to release a claim to the exemption for one or more of the children, allowing Mother to claim an exemption for the child (or children) and claim the associated CTC. But is this prudent?

Outcome: If Father agrees to transfer the CTC to Mother, her benefit would also be $2,000 per child or $6,000 for all three children. That might work for 2018, although it’s a close call. Transferring the CTC to Mother would not bestow the greatest tax benefit on the parties if her income exceeds the $200,000 AGI threshold in 2019.

Consider the credit phase-out for unmarried taxpayers with an AGI of $200,000, and credit reduction by $50 for each $1,000, or fraction thereof, exceeding the threshold amount. If Mother’s AGI were $320,000 or above and Father wanted to give her the exemption for all three children, she would receive no benefit at all.

Here’s the math: $320,000 – $200,000 threshold limit = $120,000 divided by $1,000 = 120 x $50 = $6,000 – $6,000 tax credit = $0 allowable tax credit. That’s zero tax benefit for both parents. Furthermore, Form 8332 does not allow Mother to claim either Head of Household filing status or credit for child care.

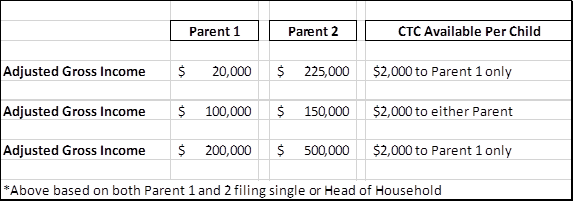

The chart below is offered to provide additional reference while not describing the example immediately above:

Who Claims the Dependent Care Credit?

Mother is paying $1,200 per month for child care. As the ARP and noncustodial parent, she cannot claim the Dependent Care Credit. Consequently, she gets no tax benefit. Father is the PRP and custodial parent, but he is not actually paying for work-related child care. So he gets no tax benefit either. Both parties lose, which means the family loses.

Option: If Father directly pays $1,200 per month for child care, then he can claim the DCC. Parents may agree to adjust their child support calculations and increase the ARP’s monthly payments by the same amount.

Here’s the math: The DCC maximum is $3,000 per child x 20 percent based on Father’s $75,000 AGI. Thus, he would receive an additional $600 tax credit for child care.

The landscape for child-related tax benefits has changed significantly. Read the IRS publications noted at the outset. Prepare to guide clients through different tax scenarios using their proposed parenting plan. Parents need to know the consequences of their decisions. Encourage all parties to collectively embrace the greatest financial benefit available to them under the new tax law.

Hear Cindy and Miles discuss Child Tax Credits in the above webinar on YouTube.

CINDY J. MACAULAY is a Director in Forensic Valuation and Litigation Support at Dixon Hughes Goodman in Memphis. She has worked as a Forensic CPA for 20 years and testifies as an expert witness.

Miles Mason, Sr. JD, CPA, Memphis divorce attorney

MILES MASON SR. practices family law in Memphis and is a graduate of the University of Memphis Cecil C. Humphreys School of Law. He authored the Forensic Accounting Deskbook, published by the American Bar Association Family Law Section. A second edition will be released this spring.