Social Security Benefits: Strategies for Divorcing Spouses

This article originally appeared in the June 2019 issue of the Tennessee Bar Journal. Citation: 55 Tennessee Bar Journal, 6 (June 2019). Copyright 2019 Tennessee Bar Journal and Miles Mason Family Law Group, PLC. Reprinted with permission. Also, thank you to the South Carolina Lawyer, magazine of the South Carolina Bar, for publishing this article in their March 2020 issue. In 2023, this article was updated. Thank you to Diana Pope for research assistance.

South Carolina Lawyer cover. Thank you to the South Carolina bar for reprinting this in their March 2020 issue.

Family law attorneys should anticipate and plan for the impact that divorce will have on their clients’ Social Security benefits, a key source of retirement income for most people. Although more retirement options are available to married couples, important choices are also available to single and divorced individuals.

Tennessee Bar Journal Cover | June 2019

For a client to get the most from Social Security, the attorney needs to know what retirement, survivor, and disability options are applicable to them, and then develop a benefits strategy before alimony and property settlement negotiations ensue in earnest.

What do you say when a divorce client asks:

“How much will I get in Social Security?”

“When is the earliest I can begin receiving benefits?”

“What happens if I remarry?”

And the kicker, “You’re a smart lawyer. Shouldn’t you know this?” The right answer is both “Yes” and “No.”

While it matters in divorce negotiations, Social Security benefits strategies are more in the nature of financial advisory services. (See note 1, below.) Nevertheless, all lawyers should have a basic understanding of what’s what. A quick disclaimer before getting started — this discussion is intended to be a general overview of the state of Social Security benefits and retirement as of the date of publications, and exceptions may apply.

Dancing Around Federal Benefits

In Tennessee divorce law, Social Security benefits are very much an enigma. From one perspective, Tennessee courts have no authority to divide or impair Social Security benefits. The benefits are what they are. From another perspective, these benefits are terribly important for alimony analysis. The eligibility for retirement benefits and their payout both increase the supporting spouse’s ability to pay and reduce the supported spouse’s need. Benefits are often substantial.

Negotiating alimony and property division from a position of strength requires a benefits strategy that encompasses Social Security, a nonnegotiable federal program. Spouses may include settlement terms in their Marital Dissolution Agreement (MDA) (n. 2) to optimize those federal benefits. Yet there is nothing spouses might agree to, attorneys might draft, or a judge might order that can alter either spouse’s individual right to Social Security benefits. This makes planning for the client’s future benefit alternatives absolutely crucial.

Social Security Benefits for Divorced Spouse and Current Spouse

Social Security Benefits: Strategies for Divorcing Spouses, by Miles Mason, Sr.

Whether for a divorced or a current spouse, Social Security benefits are a key component of retirement. What is the benefit at full retirement age (FRA)? Will the earnings cap result in forfeited benefits? How much will annual cost-of-living adjustments (COLA) help? As a marital strategy, spouses coordinate their benefit claims. As a divorce strategy, an economically dependent spouse should seek support and property resources that complement benefits for a comfortable post-divorce lifestyle.

The supporting spouse is better off with a strategy that builds on the supported spouse’s optimized benefit. It is the duty of the counsel representing the supporting spouse to assist the client in negotiating favorable divorce terms that recognize both spouses’ need to optimize benefits and ease the financial burden of support obligations and marital asset and debt division.

Spouses negotiate and mediate alimony, equitable distribution of marital property, and parenting plan issues. The divorce attorney is in a position to guide the client toward a settlement that considers both parties’ Social Security benefits. Before negotiating financial issues for the parties’ MDA, it is crucial to obtain and review the client’s official schedule of benefits from the SSA.

Social Security Planning for Aging Spouses

We have been warned for two decades about the phenomenal number of Baby Boomers heading into retirement. Boomers are now retiring at a rate of about 10,000 per day, and many are divorced or will be. Social Security benefits make up half or more of most people’s retirement income at age 65 and older. Clearly, clients who are Gen-Xers, Millennials and same-sex spouses also require strategies for optimizing benefits.

Various divorce strategies build on Social Security retirement, survivor, disability and children’s benefits. For general retirement planning, get information directly from the Social Security Administration (SSA.gov) website. Utilize the online Social Security Quick Calculator (n. 3) Certain rules and exceptions apply to public employees and important exceptions may apply to the client’s particular situation. Family lawyers don’t know everything about Social Security benefits, so be willing to refer technical retirement benefits questions to a Social Security benefits lawyer, financial advisor, or tax attorney, especially if related to income taxes. For additional reference, Mary Beth Franklin, CFP, contributing editor of InvestmentNews, has an ebook on the topic, Maximizing Social Security Retirement Benefits.

Benefits Based on Other Spouse’s Work Record

A benefit strategy should strive to obtain the maximum allowable benefit after divorce for when it’s finally time for the client to retire. Full retirement age depends upon your client’s birth year but will not be later than age 67. Note that a worker may delay retirement to age 70, the maximum age for delayed credits. Explain to your client that his or her decision to optimize personal benefits takes nothing away from the former spouse’s benefit or from his or her current spouse if remarried. (Did a spouse intentionally evade FICA tax during the marriage by earning cash on the side thereby reducing the benefit amount? Keep an eye out for this occurrence and for similar clues warranting deeper investigation into the possibility of concealed income and hidden assets.)

To develop a fact-based strategy, each divorcing spouse should obtain his or her own Social Security Statement from SSA.gov. The official report is the only way to know with certainty what benefits will be paid based upon each spouse’s own work record.

Not a first divorce for your client or the other spouse? Fortunately, or unfortunately, the same rules apply. Benefits are collected on an individual’s own work record and on the work record of one former spouse. There is no stacking marriages or combining work records to increase benefit amounts — that’s a myth and is not permitted.

What Percentage of Social Security Benefits for Divorced Spouses?

Say that you represent the economically dependent spouse. Assuming the client qualifies, to determine how much his or her benefit will be as a divorced spouse, the SSA compares the client’s work record with the other spouse’s work record (divide in half as though still married). Your client will receive the larger amount. The maximum spousal benefit is 50 percent of the former spouse’s retirement benefit at FRA. This is critical for the stay-at-home parent or the spouse who managed the family business but never drew a salary.

Statistically in divorce, women suffer economically more than do men. Look for ways in which those financial negatives may be turned around. (n. 4) Divorcing spouses of both sexes need to make decisions based on knowledge, not guesswork. Recommend that your clients consult with financial advisors and planners about personal retirement planning. Have a local referral list ready, too. It’s that important.

How Much Social Security Does an Ex-Spouse Get?

Qualifying for Social Security benefits generally requires accumulating 40 credits in lifetime earnings — this is one’s work record. If the client does not qualify on his or her own work record or it’s insufficient, then the client may qualify on the former spouse’s work record (former spouse as in after the divorce). A few rules determine the client’s right to collect on a former spouse’s benefit:

- The client must have been married at least 10 years to that former spouse. Is the marriage hovering at 9.5 years? Hold off filing for divorce.

- Divorce proceedings already pending? Delay them. The divorce decree must be entered after 10 years of marriage, not a day sooner.

- The client must be at least 62, the earliest retirement age.

- The client must be unmarried. Benefits accrued under the prior marriage are revoked by remarriage but are unaffected by the former spouse’s remarriage. (If the client’s new marriage ends in death, divorce or annulment then the right to an earlier former spouse’s benefit revives.)

- The client’s work record must provide less benefit than what the client would collect based on the former spouse’s work record.

- The former spouse must qualify for Social Security before the client begins collecting on that benefit.

Author’s note, see Benefit Reduction for Early Retirement, Soc. Sec. Admin., (last visited Mar. 12, 2023).

Is the former spouse still not collecting benefits? If both parties are at least 62 years of age and have been divorced at least two years, then the client can start collecting on the former spouse’s benefit.

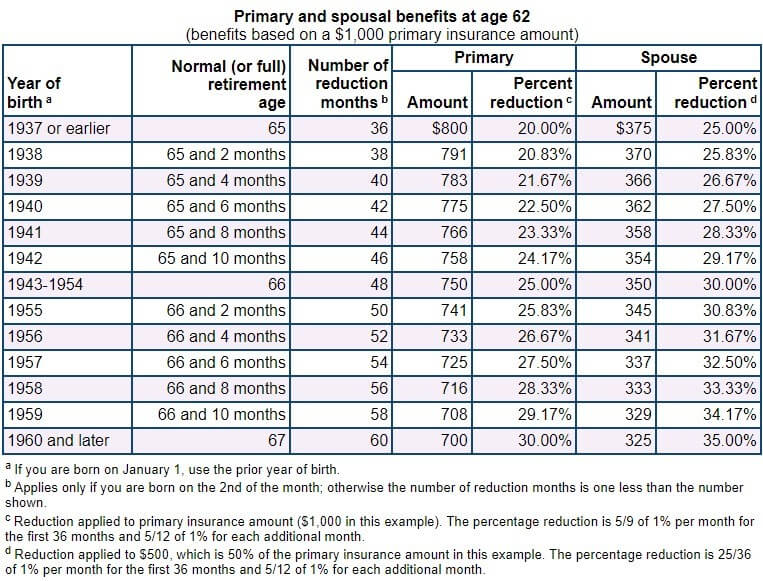

How much an ex-spouse gets depends upon his or her full retirement age (FRA) and FRA depends upon year of birth.

The chart shows the decrease in benefit amount for claiming early retirement at age 62. (Click image to go to SSA.gov. See also, n.5, below.)

Earliest Retirement Age

The individual decides when to retire, not the SSA. However, age 62 is the earliest anyone can start collecting retirement benefits. By claiming early retirement benefits (any time before the client’s FRA), the amount is forever reduced. Collect early, collect less for life.

Life expectancy matters. How is the client’s health? Does longevity run in the family? What kind of work can the client do? Will the MDA provide sufficient resources to spend down if retirement is postponed until age 70? At 70, the retirement benefit maxes out on one’s own record. A tailored alimony schedule and well-crafted property settlement could make postponing retirement feasible.

For instance, a 65-year-old may implement a divorce strategy wherein alimony is the primary source of support until age 70. Perhaps larger alimony in futuro payments for the first five years with a substantial reduction in alimony (or termination) coincident with collecting benefits at age 70. Be aware, too, that about 40 percent of claimants must pay income taxes on their benefits. Another reason for the client to consult with a financial advisor and crunch the numbers.

Later Retirement

Collect later, collect more for life. By waiting until age 70 to claim the benefit on one’s own work record — the age at which Social Security maxes out — Boomers born before 1960 enjoy maximum delayed retirement credits of 32 percent. (Waiting until age 70 will not increase the spousal benefit however.) Those whose FRA is 66 enjoy an 8 percent per year delayed retirement credit, a significant plus. For those whose FRA is 67, maximum delayed retirement credits at age 70 drop to 24 percent. In either case, develop a strategy that allows the client to collect the most — simply by delaying retirement to age 70.

Importantly, the maximum spousal benefit is 50 percent of the other spouse’s primary insurance amount (PIA) benefit at FRA. However, that does not include delayed retirement credit amounts! (That’s not true for survivor benefits as discussed below.)

Updated in 2023, the Social Security Administration website provides a calculator to measure Benefits for Spouses.

Earnings after Retirement

An individual can claim Social Security benefits and continue working, for a price. If the client is earning wages at FRA, there is no reduction in benefit amount — the earnings cap is lifted. Early retirement triggers the earnings cap. Countable earnings are wages and salaries or self-employed net earnings. Fortunately, there is no limit on income from investments, pensions, rents, government benefits and the like.

How does the earnings cap apply? If the client retires early at age 62 and has employment income, then the benefit amount will be reduced by what he or she earns above the earnings limit. The SSA says, “In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age. If you will reach full retirement age in 2023, the limit on your earnings for the months before full retirement age is $56,520.” For more detail, visit What happens if I work and get Social Security retirement benefits? (Be sure to visit SSA.gov for current-year earnings limits.) The SSA withholds monthly benefit payments until the earnings cap is satisfied. Months could pass with no benefit payment at all. Furthermore, excess benefits received from SSA must be repaid. A professional whose salary is well above the earnings cap may find early retirement a bad strategy. There are exceptions.

In the months just preceding full retirement age, the SSA allows greater wages to be earned without forfeit. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2023 that limit is $21,240. (See link above.) Impress upon your client the importance of determining exactly what the earnings cap will be before that early retirement date closes in.

What happens to early retirement benefits not paid because wages exceeded the earnings cap? At FRA, the SSA recalculates the benefit and gives credit for those months in which no benefit was paid due to the earnings limit. Determine the benefit amount with various earnings and retirement dates. Calculate benefits. Then head into settlement negotiations.

Age-Related Options and Other Things Divorce Lawyers Need to Know

Some older individuals have options not available to their younger counterparts. Divorce attorneys must identify the rare client who qualifies for one of two Social Security claiming strategies (receiving more later by collecting less initially). These benefit strategies were closed to most retirees by the Bipartisan Budget Act of 2015. (n. 6) Take a closer look.

File and Suspend Option

The “file and suspend” option allowed a qualifying individual to file for benefits at FRA and then immediately suspend benefits to keep working. Why did this make economic sense?

Upon claiming, the dependent spouse and minor child became eligible for auxiliary benefits.

- The qualifying spouse could continue working to age 70, accruing 8 percent per year in delayed-retirement credits.

- A lump-sum payment for suspended benefits was an available option.

- The strategy for a married couple was a coordinated effort to receive less now and more later.

Grandfathered Beneficiaries

Only those who claimed benefits at full retirement age (FRA) before the April 30, 2016, deadline by selecting the “file and suspend” option were grandfathered in. Between married spouses under prior law, only one could “file and suspend” and one could file a “restricted claim for spousal benefits” (discussed next). If they were divorced and both 62 years old or older on Jan. 1, 2016, then at FRA each could file a “restricted claim for spousal benefits” on the other’s work record. This allowed one’s own benefit to continue growing until age 70.

Client not grandfathered in? A limited “file and suspend” claim at FRA is still available to qualifying individuals. Under current law, delayed retirement credits can accrue until age 70, but during suspension no benefits can be collected by anyone.

Restricted Claim for Spousal Benefits Option

The “restricted claim for spousal benefits” option is another benefit optimization strategy, but it is for a dwindling number of divorcing spouses. By restricting a claim to spousal benefits, the individual claims the former spouse’s benefit at FRA while continuing to work, thereby increasing his or her own benefit until it tops out at age 70. It’s the best of both worlds!

Option Eligibility

Who is eligible? This option is available only to those born on or before Jan. 1, 1954. If born after that date, whether married or divorced, an individual is deemed able to file for both spousal and retirement benefits. The SSA compares records and pays the higher amount. The result is different with survivor benefits.

Ex-Spouse Social Security Benefits after Death

Another consideration for divorcing spouses is the Social Security survivor benefit for widows, widowers, and divorced former spouses. Survivor benefits are still available to those born on and after Jan. 1, 1954. A surviving divorced spouse chooses which benefit to collect first — his or her own benefit or the survivor’s benefit on the deceased former spouse. By collecting the survivor’s benefit first, one’s own retirement may be postponed in order to accumulate delayed retirement credits until age 70. Alternatively, the divorced spouse could start with his or her own benefit and switch to the survivor benefit at FRA.

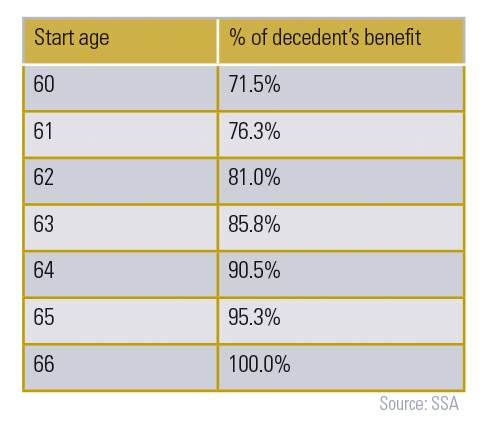

To collect the survivor benefit on a former spouse, the client must be at least 60 years old (50 if disabled) and they must have been married to each other for 10 years. The chart below (n. 7) shows the percentage the survivor receives on the deceased former spouse’s benefit.

For a more detailed chart, see Full Retirement Age for Survivors Born Between 1945 And 1956: 66.

If the decedent postponed benefits until age 70, the survivor collects 100 percent of the former spouse’s benefit with delayed retirement credits included!

What if the client remarried after the former spouse died? Timing matters. If remarried before turning 60 (50 if disabled), the survivor benefit is unavailable. As a strategy, maybe the client should wait to remarry.

When the client is raising the deceased parent’s child, the child may also receive benefits on the decedent’s work record. The child must be under age 18 or under age 19 if still a full-time high school student. The primary residential parent (PRP) could receive a benefit if the child is still under age 16. An older disabled child may also receive benefits on the deceased parent’s work record. (n. 8)

What if the other spouse dies during divorce proceedings? Of course, the marriage terminates immediately with divorce proceedings dismissed. With regard to benefit collection, the marriage must have lasted nine months for a widow or widower to collect the survivor benefit, and they must have been married one year for the survivor to collect the spousal benefit.

One Last Thought

Start preparing a Social Security benefit strategy early in the divorce representation. For purposes of retirement planning, the client needs to know what alimony arrangement and division of marital assets and debts will allow for comfortable living when added to retirement, disability or survivor benefits. Engaging a financial advisor in the process can help with optimizing the client’s right to benefits.

The longer the marriage and the closer to retirement the spouses are, the more pressing this concern becomes. Divorce cannot add to or subtract from either spouse’s benefit, but a tailored MDA can build nicely on a benefit foundation.

Additional Resources:

Your Retirement Checklist (SSA Pub. 05-10377). (n. 9).

How Work Affects Your Benefits (SSA Pub. 05-10069). (n. 10).

NOTES:

1. Thank you to Carol Lee Royer, CFP, CFA, CDFA, and Kathy Williams, CFP, CDFA, both with Waddell & Associates, for their contributions to this article. To learn more about the financial advisory services they provide visit

waddellandassociates.com.

2. Tenn. Code Ann. § 36-4-103.

3. Social Security Quick Calculator, SOC. SEC. ADMIN., http://ssa.gov/OACT/quickcalc/ (last visited Mar. 12, 2023).

4. Jeff Landers, CDFA, long-time Forbes.com contributor, often writes about addressing the financial negatives divorce can have on women.

5. “SSA: Early or Late Retirement?”

6. Pub. L. No. 114-74, 129 Stat. 584 (2015).

7. “SSA: Full Retirement Age for Survivors Born Between 1945 and 1956: 66”

8. “SSA: Benefits Planner: If You Are the Survivor”

9. “SSA: Your Retirement Checklist”

10. “SSA: How Work Affects Your Benefits”

Warning: Always check current social security law applicable to you. When in doubt, seek advice from a lawyer with social security benefits experience or a financial advisor you trust.