2019 Tax Law: Transfer of Property in a Divorce Settlement

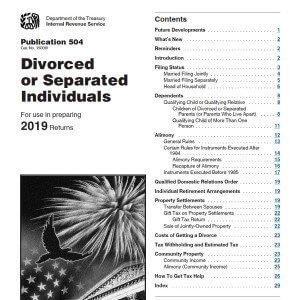

Tax Issues When Dividing Property Due to Divorce: IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

Tax Issues When Dividing Property Due to Divorce. Tax-Free Transfers Incident to a Divorce – What Qualifies? Making Tax-Smart Property Transfers in Divorce.

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Transfer Between Spouses

Generally, no gain or loss is recognized on a transfer of property from you to (or in trust for the benefit of):

- Your spouse, or

- Your former spouse, but only if the transfer is incident to your divorce.

This rule applies even if the transfer was in exchange for cash, the release of marital rights, the assumption of liabilities, or other consideration.

Exceptions to nonrecognition rule. This rule doesn’t apply in the following situations.

- Your spouse or former spouse is a nonresident alien.

- Certain transfers in trust, discussed later.

- Certain stock redemptions under a divorce or separation instrument or a valid written agreement that are taxable under applicable tax law, as discussed in Regulations section 1.1041-2.

Property subject to nonrecognition rule. The term “property” includes all property whether real or personal, tangible or intangible, or separate or community. It includes property acquired after the end of your marriage and transferred to your former spouse. It doesn’t include services.

Health savings account (HSA). If you transfer your interest in an HSA to your spouse or former spouse under a divorce or separation instrument, it isn’t considered a taxable transfer. After the transfer, the interest is treated as your spouse’s HSA.

Archer medical savings account (MSA). If you transfer your interest in an Archer MSA to your spouse or former spouse under a divorce or separation instrument, it isn’t considered a taxable transfer. After the transfer, the interest is treated as your spouse’s Archer MSA.

Individual retirement arrangement (IRA). The treatment of the transfer of an interest in an IRA as a result of divorce is similar to that just described for the transfer of an interest in an HSA and an Archer MSA. See IRA transferred as a result of divorce, earlier, under Individual Retirement Arrangements.

Incident to divorce. A property transfer is incident to your divorce if the transfer:

- Occurs within 1 year after the date your marriage ends, or

- Is related to the end of your marriage.

A divorce, for this purpose, includes the end of your marriage by annulment or due to violations of state laws.

Related to end of marriage. A property transfer is related to the end of your marriage if both of the following conditions apply.

- The transfer is made under your original or modified divorce or separation instrument.

- The transfer occurs within 6 years after the date your marriage ends.

Unless these conditions are met, the transfer is presumed not to be related to the end of your marriage. However, this presumption won’t apply if you can show that the transfer was made to carry out the division of property owned by you and your spouse at the time your marriage ended. For example, the presumption won’t apply if you can show that the transfer was made more than 6 years after the end of your marriage because of business or legal factors which prevented earlier transfer of the property and the transfer was made promptly after those factors were taken care of.

Transfers to third parties. If you transfer property to a third party on behalf of your spouse (or former spouse, if incident to your divorce), the transfer is treated as two transfers.

- A transfer of the property from you to your spouse or former spouse.

- An immediate transfer of the property from your spouse or former spouse to the third party.

You don’t recognize gain or loss on the first transfer. Instead, your spouse or former spouse may have to recognize gain or loss on the second transfer.

For this treatment to apply, the transfer from you to the third party must be one of the following.

- Required by your divorce or separation instrument

- Requested in writing by your spouse or former spouse

- Consented to in writing by your spouse or former spouse. The consent must state that both you and your spouse or former spouse intend the transfer to be treated as a transfer from you to your spouse or former spouse subject to the rules of Internal Revenue Code section 1041. You must receive the consent before filing your tax return for the year you transfer the property.

Caution! This treatment doesn’t apply to transfers to which Regulations section 1.1041-2 (certain stock redemptions) applies.

Transfers in trust. If you make a transfer of property in trust for the benefit of your spouse (or former spouse, if incident to your divorce), you generally don’t recognize any gain or loss.

However, you must recognize gain or loss if, incident to your divorce, you transfer an installment obligation in trust for the benefit of your former spouse. For information on the disposition of an installment obligation, see Pub. 537, Installment Sales.

You also must recognize as gain on the transfer of property in trust the amount by which the liabilities assumed by the trust, plus the liabilities to which the property is subject, exceed the total of your adjusted basis in the transferred property.

Example. You own property with a fair market value of $12,000 and an adjusted basis of $1,000. You transfer the property in trust for the benefit of your spouse. The trust didn’t assume any liabilities. The property is subject to a $5,000 liability. Your recognized gain is $4,000 ($5,000 − $1,000).

Reporting income from property. You should report income from property transferred to your spouse or former spouse as shown in Table 5.

For information on the treatment of interest on transferred U.S. savings bonds, see chapter 1 of Pub. 550, Investment Income and Expenses.

Records. When you transfer property to your spouse (or former spouse, if incident to your divorce), you must give your spouse sufficient records to determine the adjusted basis and holding period of the property on the date of the transfer. If you transfer investment credit property with recapture potential, you also must provide sufficient records to determine the amount and period of the recapture.

Tax treatment of property received. Property you receive from your spouse (or former spouse, if the transfer is incident to your divorce) is treated as acquired by gift for income tax purposes. Its value isn’t taxable to you.

Basis of property received. Your basis in property received from your spouse (or former spouse, if incident to your divorce) is the same as your spouse’s adjusted basis. This applies for determining either gain or loss when you later dispose of the property. It applies whether the property’s adjusted basis is less than, equal to, or greater than either its value at the time of the transfer or any consideration you paid. It also applies even if the property’s liabilities are more than its adjusted basis.

This rule generally applies to all property received after July 18, 1984, under a divorce or separation instrument in effect after that date. It also applies to all other property received after 1983 for which you and your spouse (or former spouse) made a “section 1041 election” to apply this rule. For information about how to make that election, see Temporary Regulations section 1.1041-1T(g).

Example. Karen and Don owned their home jointly. Karen transferred her interest in the home to Don as part of their property settlement when they divorced last year.

Don’s basis in the interest received from Karen is her adjusted basis in the home. His total basis in the home is their joint adjusted basis.

Property received before July 19, 1984. Your basis in property received in settlement of marital support rights before July 19, 1984, or under an instrument in effect before that date (other than property for which you and your spouse (or former spouse) made a “section 1041 election”) is its fair market value when you received it.

Example. Larry and Gina owned their home jointly before their divorce in 1983. That year, Gina received Larry’s interest in the home in settlement of her marital support rights. Gina’s basis in the interest received from Larry is the part of the home’s fair market value proportionate to that interest. Her total basis in the home is that part of the fair market value plus her adjusted basis in her own interest.

Property transferred in trust. If the transferor recognizes gain on property transferred in trust, as described earlier under Transfers in trust, the trust’s basis in the property is increased by the recognized gain.

Example. Your spouse transfers property in trust, recognizing a $4,000 gain. Your spouse’s adjusted basis in the property was $1,000. The trust’s basis in the property is $5,000 ($1,000 + $4,000).

Table 5. Property Transferred Pursuant to Divorce

The tax treatment of items of property transferred from you to your spouse or former spouse pursuant to your divorce is shown below.

| IF you transfer … | THEN you … | AND your spouse or former spouse … | FOR more information, see … |

| income-producing property (such as an interest in a business, rental property, stocks, or bonds) | include on your tax return any profit or loss, rental income or loss, dividends, or interest generated or derived from the property during the year until the property is transferred | reports any income or loss generated or derived after the property is transferred. | Pub. 550, Investment Income and Expenses. (See Ownership transferred under U. S. Savings Bonds in chapter 1.) |

| interest in a passive activity with unused passive activity losses | can’t deduct your accumulated unused passive activity losses allocable to the interest | increases the adjusted basis of the transferred interest by the amount of the unused losses. | Pub. 925, Passive Activity and At-Risk Rules. |

| investment credit property with recapture potential | don’t have to recapture any part of the credit | may have to recapture part of the credit if he or she disposes of the property or changes its use before the end of the recapture period. | Form 4255, Recapture of Investment Credit. |

| interests in nonstatutory stock options and nonqualified deferred compensation | don’t include any amount in gross income upon the transfer | includes an amount in gross income when he or she exercises the stock options or when the deferred compensation is paid or made available to him or her. |

Divorce & Taxes: Your 2019 Update

See Miles Mason, Sr.’s article which was the cover story for the Tennessee Bar Journal: Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan.

See our Tennessee Family Law Blog post series on Divorce & Taxes 2019:

- IRS “Reminders” for Divorced or Separated Individuals

- IRS Requirements to Deduct Alimony on Your Tax Return

- General Tax Rules for Alimony After Divorce

- If You Qualify, You Want to File as Head of Household After Divorce

- 2019 Tax Law: Transfer of Property in a Divorce Settlement

- Are legal fees for divorce tax deductible in 2019?

- Dividing an IRA: 2019 Tax & Divorce Law

- Who Pays the Taxes on a QDRO Distribution after Divorce?

- Sale of Principal Residence after Divorce: 2019 Tax Law

- Assignment of Estimated Tax Payments in a Divorce