Deducting Costs of Getting a Divorce

- At April 25, 2020

- By Miles Mason

- In After Divorce, Divorce Tips

0

0

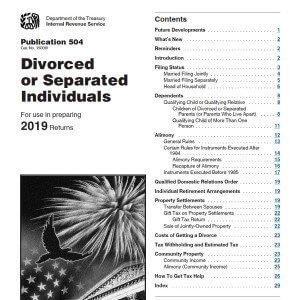

IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

Deducting Costs of Getting a Divorce. The IRS takes a dim view of deducting legal costs of divorce. Got it? But what if you are a business owner defending your ownership interest? Is that different? Also, see the discussion below about adding certain expenses to the tax basis of your assets.

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: With alimony, there are technical answers and there are practical answers. The practical answers come with many years of experience. (My dad was a tax CPA for over 35 years in Memphis.) So what? My strong recommendation is not to play around by guessing. Engage an experienced CPA you trust to help you make close calls. Plus, what makes alimony a mess to figure out is that the terms used by the IRS don’t easily translate into corresponding terms in Tennessee family law.

Mason Comment 3: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Costs of Getting a Divorce

You can’t deduct legal fees and court costs for getting a divorce. In addition, you can’t deduct legal fees paid for tax advice in connection with a divorce and legal fees to get alimony or fees you pay to appraisers, actuaries, and accountants for services in determining your correct tax or in helping to get alimony.

Other Nondeductible expenses. You can’t deduct the costs of personal advice, counseling, or legal action in a divorce. These costs aren’t deductible, even if they are paid, in part, to arrive at a financial settlement or to protect income-producing property.

You also can’t deduct legal fees you pay for a property settlement. However, you can add it to the basis of the property you receive. For example, you can add the cost of preparing and filing a deed to put title to your house in your name alone to the basis of the house.

Finally, you can’t deduct fees you pay for your spouse or former spouse, unless your payments qualify as alimony. (See Payments to a third party under Alimony.) If you have no legal responsibility arising from the divorce settlement or decree to pay your spouse’s legal fees, your payments are gifts and may be subject to the gift tax.

There are more postings on divorce and taxes in the Divorce Tips category of our Tennessee Family Law Blog.