If You Qualify, You Want to File as Head of Household After Divorce

- At April 25, 2020

- By Miles Mason

- In After Divorce, Child Custody, Divorce Tips

0

0

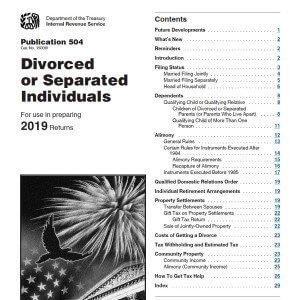

If You Qualify, You Want to File as Head of Household: IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

After divorce, filing head of household (as opposed to filing as a single person) can save you real money if you qualify. Unmarried? Keeping up a home? Itemized deductions on separate returns? Who are qualifying persons? What if a qualifying person died?

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: With alimony, there are technical answers and there are practical answers. The practical answers come with many years of experience. (My dad was a tax CPA for over 35 years in Memphis.) So what? My strong recommendation is not to play around by guessing. Engage an experienced CPA you trust to help you make close calls. Plus, what makes alimony a mess to figure out is that the terms used by the IRS don’t easily translate into corresponding terms in Tennessee family law.

Mason Comment 3: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Head of Household

Filing as head of household has the following advantages:

- You can claim the standard deduction even if your spouse files a separate return and itemizes deductions.

- Your standard deduction is higher than is allowed if you claim a filing status of single or married filing separately.

- Your tax rate usually will be lower than it is if you claim a filing status of single or married filing separately.

- You may be able to claim certain credits (such as the dependent care credit and the earned income credit) you can’t claim if your filing status is married filing separately.

- Income limits that reduce your child tax credit and your retirement savings contributions credit, for example, are higher than the income limits if you claim a filing status of married filing separately.

Requirements. You may be able to file as head of household if you meet all the following requirements.

- You are unmarried or “considered unmarried” on the last day of the year.

- You paid more than half the cost of keeping up a home for the year.

- A “qualifying person” lived with you in the home for more than half the year (except for temporary absences, such as school). However, if the “qualifying person” is your dependent parent, he or she doesn’t have to live with you. See Special rule for parent, later, under Qualifying person.

Considered unmarried. You are considered unmarried on the last day of the tax year if you meet all the following tests.

- You file a separate return. A separate return includes a return claiming married filing separately, single, or head of household filing status.

- You paid more than half the cost of keeping up your home for the tax year.

- Your spouse didn’t live in your home during the last 6 months of the tax year. Your spouse is considered to live in your home even if he or she is temporarily absent due to special circumstances. See Temporary absences, later.

- Your home was the main home of your child, stepchild, or foster child for more than half the year. (See Qualifying person, later, for rules applying to a child’s birth, death, or temporary absence during the year.)

- You must be able to claim the child as a dependent. However, you meet this test if you can’t claim the child as a dependent only because the noncustodial parent can claim the child. The general rules for claiming a dependent are shown in Table 3.

Caution! If you were considered married for part of the year and lived in a community property state (one of the states listed later under Community Property), special rules may apply in determining your income and expenses. See Pub. 555 for more information.

Nonresident alien spouse. If your spouse was a nonresident alien at any time during the tax year, and you haven’t chosen to treat your spouse as a resident alien, you are considered unmarried for head of household purposes. However, your spouse isn’t a qualifying person for head of household purposes. You must have another qualifying person and meet the other requirements to file as head of household.

Keeping up a home. You are keeping up a home only if you pay more than half the cost of its upkeep for the year. This includes rent, mortgage interest, real estate taxes, insurance on the home, repairs, utilities, and food eaten in the home. This doesn’t include the cost of clothing, education, medical treatment, vacations, life insurance, or transportation for any member of the household.

Qualifying person. Table 2 shows who can be a qualifying person. Any person not described in Table 2 isn’t a qualifying person.

Generally, the qualifying person must live with you for more than half of the year.

Special rule for parent. If your qualifying person is your father or mother, you may be eligible to file as head of household even if your father or mother doesn’t live with you. However, you must be able to claim your father or mother as a dependent. Also, you must pay more than half the cost of keeping up a home that was the main home for the entire year for your father or mother.

You are keeping up a main home for your father or mother if you pay more than half the cost of keeping your parent in a rest home or home for the elderly.

Death or birth. If the person for whom you kept up a home was born or died in 2019, you still may be able to file as head of household. If the person is your qualifying child, the child must have lived with you for more than half the part of the year he or she was alive. If the person is anyone else, see Pub. 501.

Temporary absences. You and your qualifying per- son are considered to live together even if one or both of you are temporarily absent from your home due to special circumstances such as illness, education, business, vacation, military service, or detention in a juvenile facility. It must be reasonable to assume that the absent person will return to the home after the temporary absence. You must continue to keep up the home during the absence.

Kidnapped child. You may be eligible to file as head of household even if the child who is your qualifying person has been kidnapped. You can claim head of house- hold filing status if all the following statements are true.

- The child is presumed by law enforcement authorities to have been kidnapped by someone who isn’t a member of your family or the child’s family.

- In the year of the kidnapping, the child lived with you for more than half the part of the year before the kid- napping.

- In the year of the child’s return, the child lived with you for more than half the part of the year following the date of the child’s return.

- You would have qualified for head of household filing status if the child hadn’t been kidnapped.

This treatment applies for all years until the earliest of:

- The year the child is returned,

- The year there is a determination that the child is dead, or

- The year the child would have reached age 18.

For more information on filing as head of household, see Pub. 501.

Table 1. Itemized Deductions on Separate Returns

This table shows itemized deductions you can claim on your married filing separate return whether you paid the expenses separately with your own funds or jointly with your spouse.

Caution: If you live in a community property state, these rules don’t apply. See Community Property.

| IF you paid … | AND you … | THEN you can deduct on your separate federal return … |

| medical expenses | paid with funds deposited in a joint checking account in which you and your spouse have an equal interest | half of the total medical expenses, subject to certain limits, unless you can show that you alone paid the expenses. |

| state income tax | file a separate state income tax return | the state income tax you alone paid during the year. |

| file a joint state income tax return and you and your spouse are jointly and individually liable for the full amount of the state income tax | the state income tax you alone paid during the year. | |

| file a joint state income tax return and you are liable for only your own share of state income tax | the smaller of:

paid during the year, or

your spouse paid during the year multiplied by the following fraction. The numerator is your gross income and the denominator is your combined gross income. |

|

| property tax | paid the tax on property held as tenants by the entirety | the property tax you alone paid. |

| mortgage interest | paid the interest on a qualified home1 held as tenants by the entirety | the mortgage interest you alone paid. |

| casualty loss | have a casualty loss2 resulting from a federally declared disaster on a home you own as tenants by the entirety | half of the loss, subject to the deduction limits. Neither spouse may report the total casualty loss. |

1 For more information on a qualified home and deductible mortgage interest, see Pub. 936, Home Mortgage Interest Deduction. 2 For more information on casualty losses, see Pub. 547, Casualties, Disasters and Thefts.

2 For more information on casualty losses, see Pub. 547, Casualties, Disasters and Thefts.

Divorce & Taxes: Your 2019 Update

See Miles Mason, Sr.’s article which was the cover story for the Tennessee Bar Journal: Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan.

See our Tennessee Family Law Blog post series on Divorce & Taxes 2019:

- IRS “Reminders” for Divorced or Separated Individuals

- IRS Requirements to Deduct Alimony on Your Tax Return

- General Tax Rules for Alimony After Divorce

- If You Qualify, You Want to File as Head of Household After Divorce

- 2019 Tax Law: Transfer of Property in a Divorce Settlement

- Are legal fees for divorce tax deductible in 2019?

- Dividing an IRA: 2019 Tax & Divorce Law

- Who Pays the Taxes on a QDRO Distribution after Divorce?

- Sale of Principal Residence after Divorce: 2019 Tax Law

- Assignment of Estimated Tax Payments in a Divorce