Who Pays the Taxes on a QDRO Distribution after Divorce?

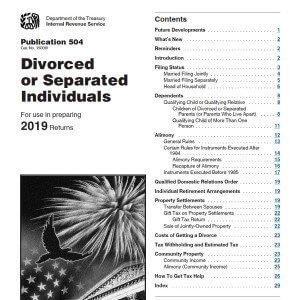

Who Pays the Taxes on a QDRO Distribution? IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

Who Pays the Taxes on a QDRO Distribution after Divorce?

If you receive an eligible rollover distribution under a QDRO as the plan participant’s spouse or former spouse, you may be able to roll it over tax free into a traditional individual retirement arrangement (IRA) or another qualified retirement plan.

Do I have to pay taxes on a QDRO? Qualified Domestic Relations Order Tax Implications.

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Qualified Domestic Relations Order

A qualified domestic relations order (QDRO) is a judgment, decree, or court order (including an approved property settlement agreement) issued under a state’s domestic relations law that:

- Recognizes someone other than a participant as having a right to receive benefits from a qualified retirement plan (such as most pension and profit-sharing plans) or a tax-sheltered annuity;

- Relates to payment of child support, alimony, or marital property rights to a spouse, former spouse, child, or other dependent of the participant; and

- Specifies certain information, including the amount or part of the participant’s benefits to be paid to the participant’s spouse, former spouse, child, or other dependent.

Benefits paid to a child or other dependent. Benefits paid under a QDRO to the plan participant’s child or other dependent are treated as paid to the participant. For information about the tax treatment of benefits from retirement plans, see Pub. 575, Pension and Annuity Income.

Benefits paid to a spouse or former spouse. Benefits paid under a QDRO to the plan participant’s spouse or former spouse generally must be included in the spouse’s or former spouse’s income. If the participant contributed to the retirement plan, a prorated share of the participant’s cost (investment in the contract) is used to figure the taxable amount.

The spouse or former spouse can use the special rules for lump-sum distributions if the benefits would have been treated as a lump-sum distribution had the participant received them. For this purpose, consider only the balance to the spouse’s or former spouse’s credit in determining whether the distribution is a total distribution. See Lump-Sum Distributions in Pub. 575 for information about the special rules.

Rollovers. If you receive an eligible rollover distribution under a QDRO as the plan participant’s spouse or former spouse, you may be able to roll it over tax free into a traditional individual retirement arrangement (IRA) or another qualified retirement plan.

For more information on the tax treatment of eligible rollover distributions, see Pub. 575.

Divorce & Taxes: Your 2019 Update

See Miles Mason, Sr.’s article which was the cover story for the Tennessee Bar Journal: Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan.

See our Tennessee Family Law Blog post series on Divorce & Taxes 2019:

- IRS “Reminders” for Divorced or Separated Individuals

- IRS Requirements to Deduct Alimony on Your Tax Return

- General Tax Rules for Alimony After Divorce

- If You Qualify, You Want to File as Head of Household After Divorce

- 2019 Tax Law: Transfer of Property in a Divorce Settlement

- Are legal fees for divorce tax deductible in 2019?

- Dividing an IRA: 2019 Tax & Divorce Law

- Who Pays the Taxes on a QDRO Distribution after Divorce?

- Sale of Principal Residence after Divorce: 2019 Tax Law

- Assignment of Estimated Tax Payments in a Divorce