General Tax Rules for Alimony After Divorce

- At April 24, 2020

- By Miles Mason

- In After Divorce, Alimony, Divorce Tips

0

0

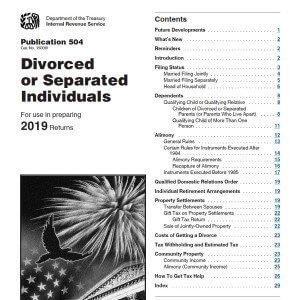

General tax rules for alimony after divorce: IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

General tax rules for alimony after divorce. What is not alimony? Difference between child support? What if child support is underpaid? What about payments to persons other than the former spouse? Jointly-owned home expenses? Life insurance premiums?

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: With alimony, there are technical answers and there are practical answers. The practical answers come with many years of experience. (My dad was a tax CPA for over 35 years in Memphis.) So what? My strong recommendation is not to play around by guessing. Engage an experienced CPA you trust to help you make close calls. Plus, what makes alimony a mess to figure out is that the terms used by the IRS don’t easily translate into corresponding terms in Tennessee family law.

Mason Comment 3: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Alimony General Tax Rules: The following rules apply to alimony.

Alimony. Amounts paid as alimony or separate maintenance payments under a divorce or separation instrument executed after 2018 won’t be deductible by the payer. Such amounts also won’t be includible in the income of the recipient. The same is true of alimony paid under a divorce or separation instrument executed before 2019 and modified after 2018, if the modification expressly states that the alimony isn’t deductible to the payer or includible in the income of the recipient.

Payments not alimony. Not all payments under a divorce or separation instrument are alimony. Alimony doesn’t include:

- Child support,

- Noncash property settlements,

- Payments that are your spouse’s part of community income, as explained later under Community Property,

- Payments to keep up the payer’s property, or

- Use of the payer’s property.

Example. Under your written separation agreement, your spouse lives rent-free in a home you own and you must pay the mortgage, real estate taxes, insurance, repairs, and utilities for the home. Because you own the home and the debts are yours, your payments for the mortgage, real estate taxes, insurance, and repairs aren’t alimony. Neither is the value of your spouse’s use of the home.

If they qualify, you may be able to deduct the payments for utilities as alimony. Your spouse must report them as income. If you itemize deductions, you can deduct the real estate taxes and, if the home is a qualified home, you also can include the interest on the mortgage in figuring your deductible interest. However, if your spouse owned the home, see Example 2 under Payments to a third party, later. If you owned the home jointly with your spouse, see Table 4. For more information, see Pub. 936, Home Mortgage Interest Deduction.

Child support. To determine whether a payment is child support, see the discussion under Certain Rules for Instruments Executed After 1984, later. If your divorce or separation agreement was executed before 1985, see the 2004 revision of Pub. 504 available at IRS.gov/ FormsPubs.

Underpayment. If both alimony and child support payments are called for by your divorce or separation instrument, and you pay less than the total required, the payments apply first to child support and then to alimony.

Example. Your divorce decree calls for you to pay your former spouse $200 a month ($2,400 ($200 x 12) a year) as child support and $150 a month ($1,800 ($150 x 12) a year) as alimony. If you pay the full amount of $4,200 ($2,400 + $1,800) during the year, you can deduct $1,800 as alimony and your former spouse must report $1,800 as alimony received. If you pay only $3,600 during the year, $2,400 is child support. You can deduct only $1,200 ($3,600 – $2,400) as alimony and your former spouse must report $1,200 as alimony received.

Payments to a third party. Cash payments, checks, or money orders to a third party on behalf of your spouse under the terms of your divorce or separation instrument can be alimony, if they otherwise qualify. These include payments for your spouse’s medical expenses, housing costs (rent, utilities, etc.), taxes, tuition, etc. The payments are treated as received by your spouse and then paid to the third party.

Example 1. Under your divorce decree, you must pay your former spouse’s medical and dental expenses. If the payments otherwise qualify, you can deduct them as alimony on your return. Your former spouse must report them as alimony received and can include them in figuring deductible medical expenses.

Example 2. Under your separation agreement, you must pay the real estate taxes, mortgage payments, and insurance premiums on a home owned by your spouse. If they otherwise qualify, you can deduct the payments as alimony on your return, and your spouse must report them as alimony received. Your spouse may be able to deduct the real estate taxes and home mortgage interest, subject to the limitations on those deductions. See the Instructions for Schedule A (Form 1040 or 1040-SR). However, if you owned the home, see the example under Payments not alimony, earlier. If you owned the home jointly with your spouse, see Table 4.

Life insurance premiums. Alimony includes premiums you must pay under your divorce or separation instrument for insurance on your life to the extent your spouse owns the policy.

Payments for jointly-owned home. If your divorce or separation instrument states that you must pay expenses for a home owned by you and your spouse or former spouse, some of your payments may be alimony. See Table 4.

However, if your spouse owned the home, see Example 2 under Payments to a third party, earlier. If you owned the home, see the example under Payments not alimony, earlier.

Table 4. Expenses for a Jointly-Owned Home

Use the table below to find how much of your payment is alimony and how much you can claim as an itemized deduction.

| IF you must pay all of the … | AND your home is … | THEN you can deduct and your spouse (or former spouse) must include as alimony … | AND you can claim as an itemized deduction … |

| mortgage payments (principal and interest) | jointly owned | half of the total payments | half of the interest as interest expense (if the home is a qualified home).1 |

| real estate taxes and home insurance | held as tenants in common | half of the total payments | half of the real estate taxes2 and none of the home insurance. |

| held as tenants by the entirety or in joint tenancy | none of the payments | all of the real estate taxes and none of the home insurance. |

1 Your spouse (or former spouse) can deduct the other half of the interest if the home is a qualified home.

2 Your spouse (or former spouse) can deduct the other half of the real estate taxes.

Divorce & Taxes: Your 2019 Update

See Miles Mason, Sr.’s article which was the cover story for the Tennessee Bar Journal: Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan.

See our Tennessee Family Law Blog post series on Divorce & Taxes 2019:

- IRS “Reminders” for Divorced or Separated Individuals

- IRS Requirements to Deduct Alimony on Your Tax Return

- General Tax Rules for Alimony After Divorce

- If You Qualify, You Want to File as Head of Household After Divorce

- 2019 Tax Law: Transfer of Property in a Divorce Settlement

- Are legal fees for divorce tax deductible in 2019?

- Dividing an IRA: 2019 Tax & Divorce Law

- Who Pays the Taxes on a QDRO Distribution after Divorce?

- Sale of Principal Residence after Divorce: 2019 Tax Law

- Assignment of Estimated Tax Payments in a Divorce