IRS “Reminders” for Divorced or Separated Individuals

- At April 11, 2020

- By Miles Mason

- In After Divorce, Alimony, Divorce Tips

0

0

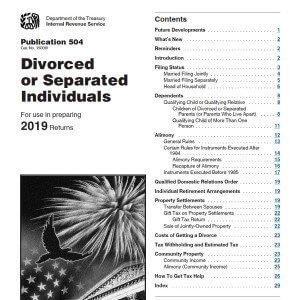

IRS Reminders for divorced and separated individuals: IRS Publication 504, Divorced or Separated Individuals is one of our favorite reference sources for tax issues relevant to our divorced or separated clients.

IRS Reminders for divorced and separated individuals: alimony law changed, tax, interest, penalties, social security numbers for kids, ITIN, change of address, and name change after divorce.

Mason Comment 1: Although I am a CPA, I hire a CPA to do my taxes. Why? I can’t keep up with all of the changes in tax law. I have to worry about keeping up with divorce law. That’s enough for me. And, for you CPA’s, my accounting experience was in audit, not tax. I hope that makes sense.

Mason Comment 2: With alimony, there are technical answers and there are practical answers. The practical answers come with many years of experience. (My dad was a tax CPA for over 35 years in Memphis.) So what? My strong recommendation is not to play around by guessing. Engage an experienced CPA you trust to help you make close calls. Plus, what makes alimony a mess to figure out is that the terms used by the IRS don’t easily translate into corresponding terms in Tennessee family law.

Mason Comment 3: As you may know, we love IRS Publication 504 Divorced or Separated Individuals – 2019. It’s our “Cliff Notes” for our divorced and separated clients. Below are some quotes from that publication. Keep in mind the publication changes every year, so if these links are broken, there is likely a more recent version available. In future years, we may just make new pages and not update this one.

Reminders

Mason Comment: “Reminders” are for those who like an executive summary of an executive summary. Or, it is the IRS saying, “For goodness sake, don’t mess this up. We are telling you twice!”

Alimony. Amounts paid as alimony or separate maintenance payments under a divorce or separation instrument executed after 2018 won’t be deductible by the payer. Such amounts also won’t be includible in the income of the recipient. The same is true of alimony paid under a divorce or separation instrument executed before 2019 and modified after 2018, if the modification expressly states that the alimony isn’t deductible to the payer or includible in the income of the recipient.

Mason Comment: More to come on Alimony.

Relief from joint liability. In some cases, one spouse may be relieved of joint liability for tax, interest, and penalties on a joint tax return. For more information, see Relief from joint liability under Married Filing Jointly.

Social security numbers for dependents. You must include on your tax return the taxpayer identification number (generally, the social security number (SSN)) of every dependent you claim. See Dependents, later.

Using and getting an ITIN. The ITIN is entered wherever an SSN is requested on a tax return. If you’re required to include another person’s SSN on your return and that person doesn’t have and can’t get an SSN, enter that person’s ITIN. The IRS will issue an ITIN to a nonresident or resident alien who doesn’t have and isn’t eligible to get an SSN. To apply for an ITIN, file Form W-7, Application for IRS Individual Taxpayer Identification Number, with the IRS. Allow 7 weeks for the IRS to notify you of your ITIN application status (9 to 11 weeks if you submit the application during peak processing periods (January 15 through April 30) or if you’re filing from overseas). If you haven’t received your ITIN at the end of that time, you can call the IRS to check the status of your application. For more information, go to IRS.gov/FormW7.

Change of address. If you change your mailing address, be sure to notify the IRS. You can use Form 8822, Change of Address.

Change of name. If you change your name, be sure to notify the Social Security Administration using Form SS-5, Application for a Social Security Card.

Divorce & Taxes: Your 2019 Update

See Miles Mason, Sr.’s article which was the cover story for the Tennessee Bar Journal: Who Gets the Credit? Calculating the New Child Tax Credits in Your Parenting Plan.

See our Tennessee Family Law Blog post series on Divorce & Taxes 2019:

- IRS “Reminders” for Divorced or Separated Individuals

- IRS Requirements to Deduct Alimony on Your Tax Return

- General Tax Rules for Alimony After Divorce

- If You Qualify, You Want to File as Head of Household After Divorce

- 2019 Tax Law: Transfer of Property in a Divorce Settlement

- Are legal fees for divorce tax deductible in 2019?

- Dividing an IRA: 2019 Tax & Divorce Law

- Who Pays the Taxes on a QDRO Distribution after Divorce?

- Sale of Principal Residence after Divorce: 2019 Tax Law

- Assignment of Estimated Tax Payments in a Divorce