Changes to Tennessee Child Support Guidelines in 2020

- At May 20, 2020

- By Miles Mason

- In Child Support, News

0

0

Thank you to the Memphis Bar Association and the Memphis Lawyer editorial board for publishing this as an article in its August 2020 issue (Volume 37, Issue 2). Reprinted by permission. Copyright 2020 Miles Mason Family Law Group, PLC.

Overview of Changes to the Guidelines

New Tennessee Child Support Guidelines are in effect as of May 10, 2020. The Guidelines apply to all child support establishment cases and all modifications of orders. See Chapter 1240-02-04 for the rule in its entirety.

New Tennessee Child Support Guidelines are in effect as of May 10, 2020. The Guidelines apply to all child support establishment cases and all modifications of orders. See Chapter 1240-02-04 for the rule in its entirety.

Various adjustments have been made over the past 15 years, but the 2020 revisions are expansive by comparison. Why the big changes? The new Guidelines represent, in part, Tennessee’s response to the federal Flexibility, Efficiency, and Modernization in Child Support Enforcement Programs final rule of 2016. Rule 1240-02-04-.03(3)(g).

How will the new Guidelines affect you and your family? Any case filed on or after May 10, 2020 must use the revised child support worksheet, revised credit worksheet, and revised child support schedule. These are available on the DHS website. Is the Department of Children’s Services involved? At the court’s discretion, an initial order could be established by DCS without necessity of a worksheet.

Although many of the rule changes are technical in nature, others are transformative. What follows is an overview of key rule changes. At first blush, these are the ones likely to have the greatest impact on family law cases.

Willful Unemployment or Underemployment

Regarding a parent’s underemployment or unemployment, the “voluntary” standard was stricken from the rule – the standard is now “willful.” In a departure from the prior rule, a parent’s incarceration can no longer be treated as willful unemployment or underemployment under the Guidelines. Rule 1240-02-04-.04(3)(a)(2).

How much income can be imputed? The amount of gross income that may be imputed is much higher under the 2020 Guidelines. The imputed income amount for males is now $43,761.00 and $35,936.00 for females. (Imputed income under the prior rule was $37,589.00 and $29,300.00, respectively.) These figures weren’t pulled from thin air. They represent Tennessee’s full-time year-round workers’ median gross income based upon the 2016 U.S. Census Bureau’s American Community Survey. Rule 1240-02-04-.04(3)(a)(2).

Expansion of Imputed Gross Income

The 2020 Guidelines changed how Tennessee courts impute gross income in child support cases.

The court has the authority to impute gross income in specific situations. For instance, imputing income is appropriate when the parent owns substantial non-income producing assets or is willfully unemployed or underemployed. Now the judge can impute income if no reliable evidence of income exists due to the parent’s failure to participate or supply financial information in a child support proceeding. Rule 1240-02-04-.04(3)(a)(2). This puts more teeth in the financial disclosure requirement, yet falls short of sanctioning for noncompliance.

The new Guidelines provide numerous factors for the court to consider when adequate or reliable evidence is lacking due to the parent’s nonparticipation in the proceedings. The court starts with the parent’s specific circumstances as they are known to be. From there, factors to consider include the parent’s assets, residence, past jobs and earnings history, work skills, education and literacy, age, health, criminal record and other barriers to employment, records of seeking work, the local job market, availability of employers willing to hire the parent, prevailing earnings level in the local community, and other relevant background factors. Rule 1240-02-04-.01(1)(d)(iii).

Counting a Parenting Time Day

What makes up a day of parenting time has also been adjusted. We still count one parent’s care, control, or direct supervision of the child for 12 consecutive hours in a 24-hour period as a “day” of parenting time. In extraordinary circumstances, the revised Guidelines allow a parent to cumulate routine time of shorter duration as a single parenting time day. Rule 1240-02-04-.02(10).

Computing Reasonable Cost Insurance

The new Guidelines introduce the concept of reasonable cost insurance as well. Generally, when available at a reasonable cost, health insurance for the child includes medical, vision, and dental coverage. Rule 1240-02-04-.02(14).

When is the cost of insurance reasonable? If the cost to the parent responsible for providing medical support does not exceed 5% of his or her gross income, then it is reasonable. Furthermore, if adding vision, dental, or both would increase the insurance cost to more than 5% of gross income, then only the medical coverage is required. Rule 1240-02-04-.02(24).

Before the 2020 revisions, a stepparent’s insurance premiums covering the child could not be included in the parent’s calculation. Now, when a stepparent carries health, vision, or dental insurance for the child, the premiums may be included and credited to the respective parent’s column of the worksheet. For example, if the mother remarried and her current spouse (the child’s stepparent) pays health insurance premiums covering the child, then the mother may be credited for the insurance amount. Rule 1240-02-04.-04(8)(a)(6).

Retroactive Support Now Matches T.C.A.

Regarding retroactive support, the revised Guidelines limit an award of retroactive support to not more than five years from the date the action was filed. The rule now complies with T.C.A. § 36-2-311(a)(11)(G). If good cause is shown and a different retroactive award is in the interest of justice, then the court may order retroactive support beyond five years. The burden of proof remains with the PRP. Rule 1240-02-04-.06(2).

Self Support Reserve Adjustment to Child Support Calculation

The updated definition of Basic Child Support Obligation (BCSO) introduces a wholly new concept – the Self Support Reserve. Rule 1240-02-04-.02(5). The reason for this change is a federal requirement that states consider the obligor’s subsistence needs, which Tennessee has done quite effectively. The SSR should help many low-income parents maintain a minimal standard of living for themselves while supporting their children.

The updated definition of Basic Child Support Obligation (BCSO) introduces a wholly new concept – the Self Support Reserve. Rule 1240-02-04-.02(5). The reason for this change is a federal requirement that states consider the obligor’s subsistence needs, which Tennessee has done quite effectively. The SSR should help many low-income parents maintain a minimal standard of living for themselves while supporting their children.

Using the income shares model of calculating support, the 2020 Guidelines combine gross income for both parents to determine an appropriate BCSO (before adjusting for parenting time and additional expenses). But when the obligor-parent’s Adjusted Gross Income (AGI) falls below a certain amount on the schedule, the BCSO may be computed using only that parent’s income.

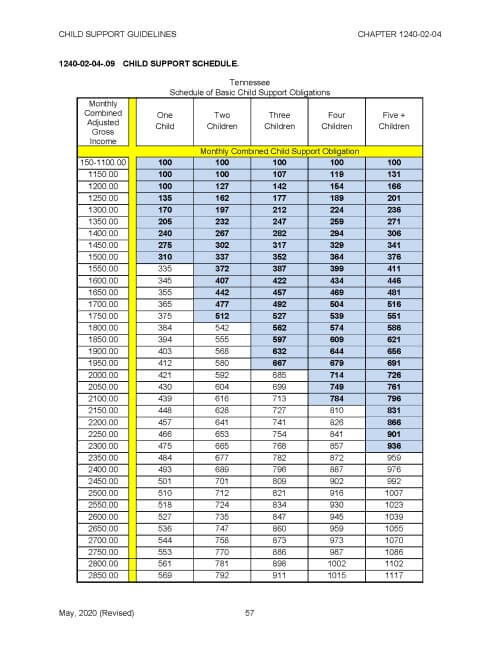

Here’s how the SSR works. The revised schedule has a “shaded area” within the monthly combined support obligation. Rule 1240-02-04-.02(8). Using the revised worksheet, when obligor income falls within the shaded area, he or she becomes eligible for the SSR adjustment. With the SSR adjustment, only the obligor’s income is used to compute the BCSO. There is no combining the AGI of both parents when the low income obligor’s AGI is in the shaded area. 1240-02-04-.02(9).

Understand, the court must order a basic support obligation unless all gross income is exempt. Rule 1240-02-04-.03(4)(a)4. Only one parent owes the BCSO, so the first step is determining which parent should pay support. The next step is determining the obligor’s eligibility for the SSR adjustment by matching his or her AGI to the schedule. If the AGI matches the shaded area and SSR eligibility is established, then compare the SSR amount to the obligor’s proportionate share under the parents’ combined AGI. Rule 1240-02-04-.04(3)(a)(6)(a). Essentially the lesser of the two figures establishes the BCSO, whether the order covers one child or five children.

How much is the SSR amount? The purpose of the SSR is to ensure the alternative residential parent (ARP) has enough income to sustain a minimal standard of living. For most obligor parents, the monthly amount for basic subsistence would be at least $1,150.00.

The minimum amount is based upon 110% of the 2018 federal poverty level for one person, which is $1,113.00 in net income per month. (The revised schedule incorporates the 2018 federal poverty level, current economic data on the cost of raising children, more current expenditures data and price level data, and changes to Tennessee incomes. Rule 1240-02-04-.03(b)(4).)

Importantly, the obligor does not get the parenting time credit when the SSR adjustment is applied. Rule 1240-02-04-.03(4)(b)(2). The SSR may impact eligibility for a parenting time adjustment in cases of split parenting and non-parent caretaker situations. The SSR is also considered if the primary residential parent (PRP) with greater income makes support payments to the ARP to assist with the children’s expenses while in the other parent’s care. Rule 1240-02-04-.04(3)(a)(7).

What about cases falling outside the shaded area? Ineligible for the SSR adjustment, families with higher incomes continue to compute the BCSO using parents’ combined AGI.

What does the shaded area look like?

Gross Income Includes Gifts, Inheritance, and Prison Earnings

How the Guidelines determine gross income also has new components. More items were added to the list of income sources. For one, gifts are expanded to include income-producing real estate along with a benefit that reduces the parent’s living expenses (free housing, for example). This is in addition to gifts of cash, liquid instruments, and gifts that can be converted to cash.

Also added to a parent’s reportable resources is any inheritance of cash, liquid instruments, an inheritance convertible to cash, and income-producing real estate. Arguably, real estate gifted to or inherited by the parent might not actually generate income yet would still be included, because it has value and “can produce income.” Rule 1240-02-04-.04(3)(a).

However insubstantial, a parent’s actual earnings while incarcerated must now be included in gross income. As discussed below, an inmate is no longer considered willfully unemployed or underemployed because of his or her incarceration.

Children Receiving Federal Benefits

Another substantive change affects federal money received for the child’s benefit. If the VA or SSA monthly benefit for the child is greater than the support order amount, then the caretaker must retain the excess and apply it for the child’s benefit. Excess federal benefits are not to be applied to prospective support and never justify reducing the child support order.

Was the VA or SSA payment a lump sum? The rule is slightly different with lump sum benefits. The excess federal benefit money is used to pay all arrearages first and, thereafter, must be retained by the caretaker for the child’s benefit. Note that lump sum benefit payments are not considered to be retroactive modifications of child support orders. Rule 1240-02-04-.04(3)(a)(5).

Minimum Child Support Order

The new Guidelines significantly increased the minimum child support order in some circumstances, raising the minimum order to at least $100.00 per month. However, there are three situations wherein the $100.00 minimum should not apply. When Supplemental Security Income (SSI) is the obligor’s only source of income. When the federal benefit (VA or SSA) for the child results in a lower than minimum calculation. And when the amount falls below the minimum because of the Parenting Time Adjustment.

The court retains discretion to deviate from the Guidelines by increasing or decreasing the amount.

Modification of Child Support Orders

Rules regarding child support modification saw numerous amendments, too. For one, the hardship deviation has been eliminated in certain cases transitioned from flat percentage to income shares guidelines. Revised instructions accompany the worksheet explaining how to proceed when the current order was based on the flat percentage guidelines.

To modify a child support order under the 2020 Guidelines, a significant variance remains an essential requirement, albeit with a twist. By definition, a significant variance is “at least fifteen percent (15%) difference in the current support obligation and the proposed support obligation.” Notably, reference to a 15% change in the ARP’s gross income is absent from the revised rule. Rule 1240-02-04-.05(2).

For pending modification cases caught in the transition from old to new guidelines, the rule is bifurcated. For the case to be modified using the current Guidelines, orders modified through the May 10 effective date plus 180 days must show a change of circumstances and 15% change between the current support order (without any deviation amount) and the proposed presumptive support order. By contrast, orders modified on or after the May 10 effective date plus 181 days need only show a 15% change between the amount of the current support order (without any deviation amount) and the amount of the proposed presumptive support order. Rule 1240-02-04-.05(2).

As discussed earlier, the impact of incarceration on support calculations has softened to a degree. The 2020 Guidelines allow the ARP sentenced to or incarcerated for more than 180 days the right to request modification of child support orders. What about Title IV-D cases? When the agency learns of the obligor’s sentencing or incarceration, it has 15 business days to notify both parties of the right to request review. The support order may be adjusted in appropriate circumstances. Rule 1240-02-04-.05(3).

Income shares guidelines have been with us since 2005 when Tennessee started shaking off flat rate support requirements. Given the 2020 revisions are the most sweeping in 15 years, expect a period of adjustment. Familiarize yourself with the revised schedule and worksheets. If you have concerns, then communicate potential issues to your attorney.